Transit Manager's Toolkit

RESOURCES > TOOLKITS

Budgeting and Finance 101

Introduction

This section of the Transit Manager's Toolkit introduces budgeting and finance concepts that rural transit managers need to know. Developing and monitoring an annual budget, ensuring that expenses are in line with the budget, and obtaining funding from a variety of sources are key to sustaining the transit system.

The section begins with a brief introduction to the Federal Transit Administration (FTA) financial management requirements for Section 5311 subrecipients. More detailed information can be found in the National RTAP training module Fundamental Financial Management for Rural Transit Agencies.

Strategic planning is a key element of budget development and financial management. The Planning and Evaluation section of this Toolkit includes information about strategic planning.

Also, it is important that any purchases using FTA funds comply with FTA procurement requirements. These are summarized in the Procurement 101 section of the Toolkit.

This section of the Toolkit is organized into the following subsections:

- FTA Financial Management Requirements for Grantees

- Internal Controls

- Non-federal Share (Local Match)

- Financial Plan

- Allowable Costs

- Indirect Costs

- Program Income

- Audit

- Reporting Requirements

- Recordkeeping Requirements

- Closeout

- Revenue from Sale of FTA-funded Assets

- Rural Transit Budget Development

- Budget Monitoring

- Developing a Multi-Year Financial Plan for Rural Transit

- Potential Funding Sources for Rural Public Transportation

- FTA Grant Programs

- Non-Federal Sources

- Grant Writing Tips

- Section Sources

FTA Financial Management Requirements for Grantees

Subrecipients of Section 5311 funding must meet federal requirements related to how grant funds and related revenues are controlled, accounted for, spent, reported on, audited, and ultimately closed out. The FTA requirements are primarily based on 2 CFR Part 200, often referred to as the “Super Circular” of the Office of Management and Budget (OMB) (it is called that because these regulations superseded several previous OMB circulars). FTA Circular 5010.1E, Award Management Requirements, provides guidance on how the Super Circular applies to FTA grants such as Section 5311.

National RTAP’s Fundamental Financial Management for Rural Transit Agencies is an in-depth training module on FTA’s financial requirements, many of which are introduced here.

Internal Controls

Grantees must have internal controls to ensure that:

- Grant-funded financial transactions are conducted in compliance with federal statutes, regulations, and the terms and conditions of the grant award

- Funds, property, and other assets are safeguarded against loss

- Transactions are properly recorded and accounted for

This includes having an accounting system that tracks how grant funds are spent and ensures accuracy and reliability in financial, statistical, and other reports, and cash management procedures to safeguard from theft.

Non-federal Share (Local Match)

Most FTA grants require non-federal funds to cover part of the cost of the transit operations, vehicle, or other project being funded by the grant. The non-federal share is often called local match and can include funding provided by the state. For example, the federally allowed maximum federal local shares for Section 5311 program are generally:

- Operating: maximum 50% federal share (minimum 50% non-federal share)

- Planning: maximum 80% federal share (minimum 20% non-federal share)

- Capital: maximum 80% federal share (minimum 20% non-federal share)

- Administrative: maximum 80% federal share (minimum 20% non-federal share)

While these are the general matching rates for Section 5311, it may be helpful to note:

- The match rates are for the net project cost. For operating grants, net project costs are calculated by subtracting fares from the total project cost.

- The maximum federal share for operating and capital grants may exceed the above amounts in states with sliding scale rates under the Section 5311 program (see pages III-16 to III-18 of FTA Circular 9040.1G).

- The federal share may exceed 80% for certain capital projects related to compliance with the Americans with Disabilities Act (ADA), the Clean Air Act (CAA), or for bicycle facilities. More information can be found on pages III-15 to III-16 of FTA Circular 9040.1G.

- Subrecipients should check with their State DOT for details about the matching rates in their state. States have the discretion to fund grants at lower federal shares, and some states provide state funds toward local match.

The local match requirement typically means the local subrecipient must have resources available to cover the non-federal share (although a state may allow in-kind match for some types of grants). As part of the grant agreement, an organization commits to having the local share available. Local match sources allowed by the federal Section 5311 program include state or local appropriations, dedicated tax revenues, private donations, net income generated from advertising and concessions, in-kind match (such as indirect costs), and non-DOT federal funds (if allowed by that particular funding source).

Financial Plan

FTA requires its recipients to have multi-year financial plans (3–5 years) for operating and capital revenues and expenses to implement FTA Awards. State DOTs, as Section 5311 recipients, may pass this requirement on to their subrecipients as they ideally need to know what their subrecipients’ financial plans are to develop their own state-level plans for the Section 5311 program. A state may require a transit development plan or other type of plan that includes some type of multi-year financial plan, including costs and funding for administration, operations, vehicles, other equipment, technology, and facilities. Whether or not this is a requirement for a grant, a multi-year financial plan is a vital tool for sustaining a transit system, as it allows the system to anticipate future year costs and apply for funding accordingly. Additional information on multi-year financial planning is found later in this section of the Toolkit.

Allowable Costs

FTA grants must be spent on the project for which the grant was awarded and must be necessary and reasonable for the project. A Section 5311 operating grant must generally be spent to provide public transportation in rural areas during a specific period of time (the grant “period of performance,” such as a fiscal year, or spanning up to three fiscal years). National RTAP’s Fundamental Financial Management for Rural Transit Agencies, Chapter 5: Cost Allowability under FTA Awards, provides detailed information on allowable costs, including discussion of the following seven criteria for allowable costs, which must:

- Be necessary, reasonable, and allocable. A cost is necessary if the expenditure is required for the proper and efficient performance and administration of a public transportation project. A cost is reasonable if it does not exceed that which would be incurred by a prudent person under the circumstances prevailing at the time the decision was made to incur the cost. A cost is allocable to a project if goods or services involved are chargeable or assignable in accordance with the relative benefits received by the project. Some costs are shared by multiple programs with different funding sources, such as the cost to insure vehicles that operate on routes funded by different programs. These costs need to be fairly distributed across services through cost allocation. National RTAP has developed a Cost Allocation Calculator to help rural transit managers allocate their costs. Readers can also find helpful information in several National RTAP webinars that offer helpful guidance, including Advanced Topics in Financial Management and Cost Allocation Tools (presented October 14, 2021) and Cost Allocation Webinar (presented March 25, 2020).

- Conform to any limitations or exclusions set forth in these principles or in the federal award. Costs for items not consistent with the Super Circular (2 CFR Part 200) or the terms and conditions of the grant award are not allowable under federal grant awards.

- Be consistent with policies and procedures that apply uniformly to both federally financed and other activities of the non-federal entity (i.e., activities financed by state or local funds). For example, if the agency has a policy to obtain five written quotes before purchasing goods or services over $3,500, then similar purchases made using Section 5311 funds must also be completed only after receiving five written quotes.

- Be accorded consistent treatment as either direct costs or indirect costs. As noted in the Fundamental Financial Management for Rural Transit Agencies, there is no universal rule for classifying costs as either direct or indirect. However, like costs must be treated consistently in like circumstances. A cost may not be allocated to a federal award as an indirect cost if any other cost incurred for the same purpose, in like circumstances, has been assigned to another federal award as a direct cost. This applies to both federally funded costs as well as projects that are not funded with federal dollars.

- Be determined in accordance with generally accepted accounting principles (GAAP). As defined in Fundamental Financial Management for Rural Transit Agencies, GAAP are the foundation of financial accounting and reflect the standards for accounting to meet federal award requirements. An organization known as the Financial Accounting Foundation oversees the Governmental Accounting Standards Board, which is responsible for setting GAAP requirements for state and local governments.

- Not be included as a cost or used to meet cost sharing or matching requirements of any other federally financed program. A cost claimed under a federal award cannot be claimed under a second federal award. Also, if the federal grant program requires a local match, funds applied to project costs to meet the local share requirement for one award cannot be claimed as match for any other federal grant award.

- Be adequately documented. For most expenses, documentation consists of vendor receipts and corresponding evidence that the vendor has been paid. There are special considerations for personnel related expenses, particularly if the employee’s time is charged, either as a direct or indirect expense, to two or more federal grants.

For more information on each of these criteria as well as other considerations in determining cost allowability, refer to Chapter 5 of Fundamental Financial Management for Rural Transit Agencies.

In addition to knowing what costs are allowed under a grant, it is also important to know that some costs are not eligible for funding under any federal grants. These include costs incurred before the grant award (unless specifically allowed by FTA), costs that have been funded by another federal grant (which would amount to “double dipping” of federal funds—see criterion 6 in the preceding list), and costs related to bad debt, fines, and alcoholic beverages. FTA grantees may incur costs that are not allowable under federal guidelines. These costs may be necessary to meet the needs of that transit system. However, these costs are not eligible for reimbursement under an FTA grant.

Indirect Costs

Some public transit systems are part of a larger organization, such as a county government or a non-profit corporation with many programs. A larger organization is likely to provide centralized services, the costs of which are shared among all departments and programs, typically through a standard percent added onto the department’s or program’s own costs. Such indirect or overhead rates must be supported by a Cost Allocation Plan (CAP) or an Indirect Cost Rate Proposal (ICRP) that is approved by FTA or whichever federal agency provides the most funding (referred to as the “cognizant federal agency”) to the organization. For more information, see National RTAP’s Fundamental Financial Management for Rural Transit Agencies, Chapter 4: Understanding Direct and Indirect Costs, as well as the National RTAP Financial Management and Indirect Cost Rates webinar (presented January 12, 2021).

Program Income

FTA grantees can earn program income through activities such as providing transportation services under contract to social service agencies, selling advertising space, renting out part of a facility, intercity bus ticket sales, and concessions. Depending upon the grant program, other types of program income can be applied toward local match or cash reserves. The Section 5311 program allows income from contracts to provide human service transportation to be used either to reduce the net project cost (treated as fare revenue) or to provide local match for operating assistance (treated as program income). Passenger fares must be deducted from the total operating costs before calculating the maximum federal share of funding. For more information on using program income derived from service agreements, see National RTAP’s Fundamental Financial Management for Rural Transit Agencies, Chapter 6: Local Match to FTA Grants, “Service Agreements” (page 104-105).

Audit

Every organization should have an annual audit, and the State DOT may require this of all subrecipients. If an organization spends $750,000 or more in a year in federal assistance from all sources (not just FTA), a federally-compliant “single audit” must be conducted in accordance with 2 CFR Part 200, subpart F. If the single audit report contains any findings and recommendations related to the FTA program or other DOT funds, the report must be submitted to the State DOT (who will submit it on behalf of the subrecipient to the FTA), and the findings must be resolved. Subrecipients should check with the State DOT for state-specific requirements related to audits. For more information, see National RTAP’s Fundamental Financial Management for Rural Transit Agencies, Chapter 10: Audit.

Reporting Requirements

States are subject to grant reporting requirements to FTA (including financial reports and milestone progress reports). To prepare their reports, and to help ensure funding is being spent in accordance with the subrecipient grant agreement, states need reports from their subrecipients. Subrecipient financial reporting requirements vary from state to state. Data required for the National Transit Database (NTD) are common to all states, including total annual revenue, sources of revenue, total annual operating costs, total annual capital costs, fleet size and type, related facilities, revenue vehicle miles, and ridership. For more information, see National RTAP’s Fundamental Financial Management for Rural Transit Agencies, Chapter 9: NTD Reporting Requirements.

Recordkeeping Requirements

Financial records, supporting documents, statistical records, and all other records pertinent to a federal award must be retained at least three years from the date of submission of the final expenditure report. Section 5311 subrecipients should retain grant-related records for at least three years beyond closeout of the subrecipient grant with the State DOT, or longer if required by the State DOT. The state may need longer to close out their grant with FTA (the grant through which the rural transit agency is a subrecipient).

Closeout

A federal grant is generally closed out after all the actions funded by the grant are complete. FTA requires that grantees (states) close out projects on a timely basis, generally 90 days after the end of the “period of performance” of the grant. To do this, states must close out sub-grants with subrecipients on a timely basis. As stated in Circular 9040.1G, FTA expects grants awarded for a specific program of projects to be completed within a reasonable, specified time frame, generally two to three years. If small amounts of funds remain in an inactive grant, the state should request that the funds be de-obligated and the project be closed out. Subrecipients need to be aware that they have a finite amount of time to spend their grant awards, after which the funds could be transferred to another project.

Revenue from Sale of FTA-funded Assets

Subrecipients that intend to sell FTA-funded facilities, vehicles, or other equipment should check with their State DOT on disposition procedures that must be followed and how the proceeds must be handled. For example, sale of FTA-funded real property or vehicles with remaining useful life valued more than $5,000 will require reimbursement to the FTA of the federal share of the value of the asset. If the value is below this threshold, the state may have its own requirements for how the proceeds can be used. The agency should refer to the State Management Plan to determine what are the disposition requirements for FTA funded real property and/or vehicles.

Rural Transit Budget Development

Whether a transit system is a stand-alone organization or a department within a government or private organization, its annual budget is an essential tool. A realistic budget can help control costs, manage case flow, spend grants appropriately, monitor system performance, and forecast future funding needs. State DOTs (and other grant funding sources) typically require their subrecipients to provide a detailed budget as part of the grant application, as part of the justification of the need for the grant. If an agency is part of a city or county government or a tribe, its budget development needs to fit within the budget development framework of the government. Strategic planning, addressed in the

Planning and Evaluation section of this Toolkit, also drives budget development. As discussed later in this section under Developing a Multi-Year Financial Plan for Rural Transit, it also vital to have a strong multi-year plan.

Developing a realistic and sustainable budget requires knowing what it costs to operate the service, maintain the vehicles and facilities, and administer and manage programs, based on the level of services currently provided along with planned expansions (or reductions). This involves estimating not only the cost to provide the service, but also what vehicles, other equipment, and facilities are needed for the transit system, when they will need to be replaced (or expanded), and what this will likely cost. It is important to understand that any changes in the scope of an agency’s service will have a direct impact on budgeting. Adding or eliminating services in a small or medium sized agency could create a variance of as much as 10-20%. Budget development also requires knowing what funding sources are available to cover costs (including fares, grants, tax revenues, advertising revenue, and in-kind support). Steps involved in developing a rural transit system budget include:

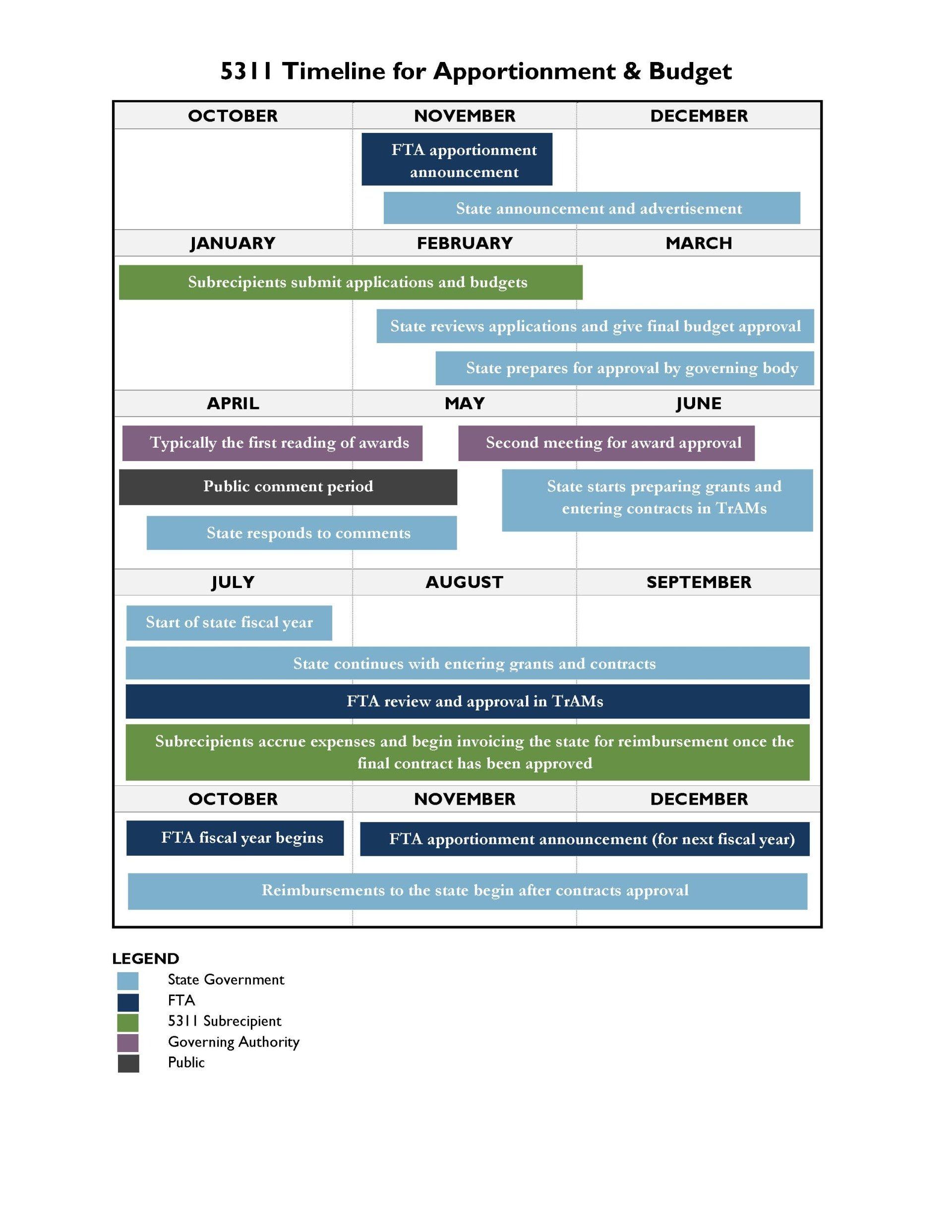

- Determine the timeline for developing the budget. If the transit system is part of a larger organization, such as a local government, tribal government, or non-profit organization, the timeline for transit budget will need to fit within the timeline of the larger organization. As a Section 5311 subrecipient, Section 5311 budget development will also need to fit within the state’s grant application cycle. A sample of a State DOT budget cycle for FTA grants is provided as Figure 1 below. Although some states have different cycles (some are biennial, for example), each state has elements of this example. Section 5311 subrecipients need to be aware of the timing of their state’s Section 5311 program, in order to develop grant application budgets accordingly (even though the agency’s overall annual budget may be developed on a different cycle).

- Determine the team that will be involved in the budgeting process. This includes managers who should provide input on the budgets they are responsible for managing.

- Review current-year budget and year-to-date expenses and revenues. If the current-year budget reflects actual costs and funding, this provides a realistic starting point for next year’s budget. If the current budget doesn’t match reality, this provides important information about where costs or revenues may need adjustment in the next year’s budget. If it is still early in the current fiscal year, also review the preceding year’s actual expenses and revenues.

- Review the organization’s mission, vision, goals, objectives, and plans for the coming year. Development of the budget, like any planning endeavor undertaken by the transit agency, should be driven by the organization’s mission and vision. Is the agency planning to expand services next year or starting a new program? Will the agency be expanding its fleet (increasing maintenance expenses)? Will the agency need to increase or reduce staffing levels to implement planned changes? Are major organizational changes planned that may result in changes to the indirect/overhead rate? Will any vehicles and/or other equipment need replacement, requiring that local match be budgeted?

- Estimate revenues and direct expenses for each program. Factors to consider in this step include historical revenues and expenses, the organization’s goals and objectives for the coming year, external factors (such as the economy, fuel prices, changes in the population of the service area, and anticipated changes to local taxes that fund services), and seasonal trends (for example, service and staffing levels may need to increase to serve visitors to a tourist destination during the summer). Be sure to get input from staff on each of the program budgets they oversee.

- Estimate indirect/overhead costs, by applying the agency’s approved indirect cost rate to estimated expenses.

- Estimate general funding revenue. This is revenue that is not specific to one program (program specific funding was estimated in an earlier step).

- Explicitly list major assumptions used to prepare the budget. Assumptions should be presented with the budget to 1) clarify to reviewers and decision-makers the reasons for proposed expenses and revenues (which they may or may not agree with), and 2) facilitate reasoned decision-making.

- Put it all together in a budget form, which includes an overall budget as well as individual budgets for each program.

Figure 1: Sample State-level Section 5311 Timeline for Apportionment & Budget

Chart Credit, Curtis Sims, Jr., CSSO, Training, Safety/Security, and RTAP Program Manager Office of Public Transit, South Carolina DOT

Additional Guidance on Developing a Budget

- National RTAP’s Fundamental Financial Management for Rural Transit Agencies, provides budget-related information in Chapter 3: Foundational Elements: Accounting/Chart of Accounts and Chapter 4: Understanding Direct and Indirect Costs.

- Texas A&M Transportation Institute’s Making Dollars and Sense of Transit Finance coursebook, Module 6: Accounting, Budgeting, and Financial Management covers both operating and capital budget development on pages 6-32 through 6-38.

- Transportation by the Numbers, a toolkit developed by the former National Center on Senior Transportation, provides guidance for determining true costs to provide human service transportation, and can also be useful for rural transit systems.

- The National Council of Nonprofits provides links to a number of resources on developing budgets designed for nonprofit organizations.

- The Wallace Foundation provides numerous resources on financial management for nonprofits, including budgeting.

- For organizations that are part of local governments, there may be state-level resources that provide budgeting guidance. For example, the Municipal Research and Services Center (MRSC), a nonprofit organization that helps local governments across Washington State, provides an overview of the budgeting process for municipalities.

- Public administration textbooks on budgeting, such as The Basics of Public Budgeting and Financial Management: A Handbook for Academics and Practitioners by Charles E. Menifield, can also clarify the public sector budget development process.

- Guidance on developing a budget written specifically for rural transit managers can be found in Comprehensive Financial Management Guidelines for Rural and Small Urban Public Transportation Providers, Chapter 5: The Budget Process. Although this resource was published in 1992 and contains older information, the principles of budget development are still valid.

Budget Monitoring

On a frequent basis, transit managers should compare actual revenues and expenses to budgeted amounts to ensure that funding sources are not exhausted before the end of the year. Ideally this should be done monthly. If costs are identified that significantly exceed what was budgeted, the manager will need to find other items within the budget where costs can be reduced or find new funding sources to cover the difference to avoid a budget deficit (“going into the red”).

Significant changes to a budget typically require approval from the agency’s governing board. Section 5311 subrecipients should also check with their State DOT for any state requirements related to budget modification and/or adjustment.

If actual costs are significantly higher than what was budgeted, grantees should check with the State DOT on options for appropriately using grant funding or covering expenses (when they exceed the budget). Note that FTA-funded grants are usually for a very specific project, and funds must be used for the costs identified in the grant budget. If an organization becomes unable to use an FTA grant as specified in the award, it generally will not have the flexibility to use the grant for other project costs.

Developing a Multi-Year Financial Plan for Rural Transit

A multi-year financial plan is a vital tool for sustaining a transit system, as it allows management to anticipate future year costs and apply for funding accordingly. A three- to five-year financial plan may also be a requirement for Section 5311 subrecipients in some states (sometimes as part of a transit development plan), to help the state prepare their own FTA-required multi-year financial plan.

A multi-year financial plan is based on the organization’s:

- Mission, vision, goals, and objectives

- Strategic plan

- Plans to increase (or decrease) services during each of the years in the plan. Any changes in an agency’s transit service levels will have a direct impact on budgeting, and future plans for service expansions or reductions should be addressed in future year budgets.

- Major service or organizational changes

- Anticipated changes in expenses for current levels of service (for example, rising fuel or insurance costs, new benefits for employees, and overall inflation)

- Potential changes in revenue (for example, implementation of a local sale tax to support transit, or loss of contracted service such as Medicaid non-emergency medical transportation)

- Planned fare policy changes (and its likely impact on ridership and overall fare revenue)

- Replacement or expansion vehicles, equipment, and facilities needed to support operations. They should be related to a service implementation plan and a vehicle replacement and expansion plan.

- Multi-year plans are often developed at a high level (summary), without the line-item detail that should be included in the annual budget. They provide annual estimates to help the organization anticipate when additional funding may be needed to ensure sustainability and ideally, planned growth.

If a State DOT requires a multi-year financial plan, they may provide guidance on how to develop this plan, sometimes as part of a larger document. Examples include:

- Florida Department of Transportation’s TDP Handbook: FDOT Guidance for Preparing & Reviewing Transit Development Plans (10-year planning horizon)

- Oregon Department of Transportation’s Transit Development Plan Guidebook (provides guidance for longer-range plans – up to 20 years – that explore different financial scenarios)

- Texas Transportation Institute’s Toolkit for Rural Transit Planning, Five-Year Operations and Financial Plan

- Virginia Department of Rail and Public Transportation’s Transit Development Plan Minimum Requirements (10 year planning horizon)

If a State DOT does not require this for rural transit systems, the above resources can still be leveraged for developing a financial plan as a recommended practice. The Texas toolkit provides guidance for developing a 5-year plan, while the other resources listed are intend for 10-year plans (or longer).

Potential Funding Sources for Rural Public Transportation

Common funding sources for rural transit systems include both FTA grant programs and non-federal sources. The following funding program descriptions are based on the programs as authorized under the Fixing America’s Surface Transportation (FAST) Act, which funded these programs through FY 2021. The Bipartisan Infrastructure Law, enacted as the Infrastructure Investment and Jobs Act, was signed into law on November 15, 2021, reauthorizing surface transportation programs for Fiscal Year (FY) 2022 through FY 2026. FTA has posted a series of fact sheets on its programs under the Bipartisan Infrastructure Law.

FTA Grant Programs

Section 5311—Formula Grants for Rural Areas

Section 5311, Formula Grants for Rural Areas, is the FTA program specifically intended for rural public transportation. Section 5311 funds operating, administrative, planning, and capital projects. The maximum federal share under Section 5311 is generally 50 percent of net operating deficit and 80 percent of non-operating costs (with higher shares allowable for vehicles and vehicle-related equipment needed to comply with the ADA and Clean Air Act as well as bicycle facilities; FTA also offers a higher share on a sliding scale for capital and operating grants in several states). FTA apportions funds to each state (as well as to the territories of American Samoa, Guam, Northern Mariana Islands and Puerto Rico) based on a formula that takes in account rural population and land area.

Each state determines its own approach to distributing funds equitably across the state. Local application for these funds is made to the State DOT, and each state has its own application process and eligibility requirements. Under the federal level, eligible recipients include states, Indian tribes, Alaskan Native villages, and groups or communities identified by the Bureau of Indian Affairs (BIA). Eligible subrecipients allowed under the federal program include states and local governmental authorities, non-profit organizations, and operators of public transportation or intercity bus service that receive FTA grant funds indirectly through a recipient. Tribes can also receive Section 5311 funding as a subrecipient through a state. Because each state administers its Section 5311 differently from other states, the best source of information about applying for Section 5311 as a subrecipient is the State DOT.

Note that, within the federal Section 5311 program, there are several sub-programs, including:

- Appalachian Development Public Transportation Assistance: Provides grants to 13 states in the Appalachian region (Alabama, Georgia, Kentucky, Maryland, Mississippi, New York, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Virginia, and West Virginia) for the delivery of safe, reliable public transportation services to rural areas in the Appalachian region. For more information, contact the State DOT.

- Intercity Bus Program: States must use 15 percent of their total Section 5311 funding to support intercity bus service, unless the governor, in consultation with intercity providers, certifies that intercity bus needs are being adequately met. For more information, contact the State DOT.

- Public Transportation on Indian Reservations Program (Tribal Transit Program): Provides grants to tribes as direct recipients for planning, capital, and, in limited circumstances, operating assistance for tribal public transit services. For more information visit the FTA Tribal Transit web page. As a future reference, National RTAP is planning additional Tribal Transit technical assistance resources.

According to the FTA Fact Sheet on Formula Grants for Rural Areas under the Bipartisan Infrastructure Law, changes made to federal Section 5311 program include establishment of fixed funding percentages for the Public Transportation on Indian Reservations and the Appalachian Development Public Transportation Assistance programs (increasing funding for these programs).

Section 5310—Enhanced Mobility of Seniors and Individuals with Disabilities

The Section 5310—Enhanced Mobility of Seniors & Individuals with Disabilities program provides funding to assist in meeting the transportation needs of older adults and people with disabilities when the transportation service provided is unavailable, insufficient, or inappropriate to meeting these needs. Funds are apportioned based on each state’s share of the population for these two groups. Formula funds are apportioned to direct recipients, which are State DOTs for rural and small urban areas (and designated recipients chosen by the governor in large urban areas), and the direct recipients award grants to subrecipients. Eligible subrecipients allowed under the federal program include private non-profit organizations, states or local government authorities, or operators of public transportation. Rural public transit systems may be eligible for Section 5310 funding depending upon the state program specifics and the types of organizations the state funds under its Section 5310 program. Federal match levels are comparable to those under Section 5311. Projects funded under the Section 5310 program must be included within a locally developed, coordinated public transit-human services transportation plan. Because each state administers its Section 5310 differently from other states, the best source of information about applying for Section 5310 as a subrecipient is the State DOT.

According to the FTA Fact Sheet on Enhanced Mobility of Seniors and Individuals with Disabilities under the Bipartisan Infrastructure Law, no changes were made to the federal Section 5310 program (beyond increases in the total program funding).

Section 5339 - Buses and Bus Facilities Program

The Section 5339 - Buses and Bus Facilities Program provides funding for capital bus and bus-related projects that will support the continuation and expansion of public transportation services. FTA awards grants to designated recipients in large urban areas and states and territories for rural and small urbanized areas. The federal program allows public agencies and private non-profit organizations engaged in public transportation to be subrecipients, and states determine how Section 5339 funds are distributed among subrecipients. The Section 5339 program includes both formula-based and competitive portions, including competitive grants for Low or No Emissions. The best sources of information on applying for FTA funding as a subrecipient is the State DOT and/or RTAP program. For examples of projects previously awarded under the program, please visit FY23 FTA Bus and Low- and No-Emission Grant Awards.

According to the FTA Fact Sheet on Buses and Bus Facilities Program under the Bipartisan Infrastructure Law, changes made to federal Section 5339 program include:

- The national distribution formula increased to states and territories.

- Grant applicants are required to use, to the extent possible, innovative procurement tools authorized under Section 3019 of the FAST Act. If fewer than five buses are purchased through a stand-alone procurement, the recipient must provide a written explanation to FTA of why the authorized procurement tools were not used.

- Applicants to the Grants for Buses and Bus Facilities competitive program who are also applying for the Low or No Emission Grants program are allowed to propose partnerships with other entities.

- Applicants must submit a zero-emission fleet transition plan with their applications for projects related to zero-emission buses.

- Requires that at least 25% of Low or No Emissions Grants funding be used for low-emission vehicles and related facilities (excluding zero emission vehicles and facilities).

- Requires that 5% of all Grants for Buses and Bus Facilities or Low or No Emissions competitive grants related to zero emission vehicles or related infrastructure be used for workforce development activities, unless the applicant certifies that less is needed to carry out their zero-emission fleet transition plan.

Areas of Persistent Poverty Program (AoPP)

Previously known as the Helping Obtain Prosperity for Everyone (HOPE) Program, Areas of Persistent Poverty Program (AoPP) funding is authorized under 49 USC 6702: Local and Regional Project Assistance. AoPP supports projects to improve transit services or facilities within areas of persistent poverty. Eligible recipients include states and federally recognized Indian Tribes. Grants are intended for eligible recipients or sub-recipients for Sections 5307, 5310, or 5311. Eligible projects include planning, engineering, technical studies, or financing plans in locations where poverty is persistent. An area of persistent poverty is defined as a county in which at least 20% of the population has been living in poverty for at least the past 30 years. Applicants may use FTA’s mapping tool to determine if a proposed project is in an Area of Persistent Poverty or Historically Disadvantaged Community. FTA’s mapping tool allows applicants to map their project areas, determine eligibility, and identify their census tract numbers. Application opportunities are posted in the form of a Notice of Funding Opportunity (NOFO). For examples of projects previously awarded under the program, visit Fiscal Year 2023 Areas of Persistent Poverty (AoPP) Project Selections.

Better Utilizing Investments to Leverage Development (BUILD)

The

Better Utilizing Investments to Leverage Development (BUILD) funds investments in transportation infrastructure, including transit.

Ferry Service for Rural Communities

The Bipartisan Infrastructure Law established a new Ferry Service for Rural Communities Program that makes federal resources available to states to ensure basic essential ferry service is provided to rural areas. This program provides capital and operating assistance for a ferry service that has operated a regular schedule at any time during the five-year period ending March 1, 2020 and has served not less than two rural areas located more than 50 sailing miles apart. For more information about this program, see the FTA Fact Sheet on Ferry Service For Rural Communities under the Bipartisan Infrastructure Law. Although this Toolkit does not address the mode of ferry service, this information is provided for rural areas that are seeking funding to support ferry service in their area.

Innovative Coordinated Access and Mobility (ICAM) Pilot Program

This funding program, established by Section 3006(b) of the FAST Act, funds capital projects to improve coordination and enhance access and mobility to vital community services for older adults, people with disabilities, and people of low income. More information about this program is provided in the

Coordination and Mobility Management section of the Toolkit under FTA Funding for Mobility Management, as well as the FTA

Fact Sheet on Innovative Coordinated Access & Mobility Pilot Program under the Bipartisan Infrastructure Law.

Emergency Relief Programs

The Federal Transit Administration’s (FTA) Emergency Relief Program (Section 5324) enables FTA to provide assistance to public transit operators in the aftermath of an emergency or major disaster. The program relies on emergency and disaster declarations to extend certain flexibilities to public transportation providers during an emergency. Capital projects needed to protect, repair, or replace facilities or equipment that are in danger of suffering serious damage, or have suffered serious damage as a result of an emergency can be funded by this program. Operating costs can also be funded when they are associated with evacuation, rescue operations, temporary public transportation service, or reestablishing, expanding, or relocating service.

Answers to Frequently Asked Questions about the FTA’s Emergency Relief Program (Section 5324) are available on the FTA’s web site.

On March 27, 2023, the FTA announced the availability of Public Transportation Emergency Relief Funds for Transit Systems Affected by Major Declared Disasters Occurring in Calendar Years 2017 & 2020-2022.

The FTA expanded eligibility of federal assistance available under FTA’s Emergency Relief Program to help transit agencies respond to COVID-19 in states where the Governor had declared an emergency. However, eligibility of federal assistance returned to its previous requirements when the Federal Emergency Management Agency (FEMA) established May 11, 2023, as the end of the incident period for all COVID-19 emergency and major disaster declarations. At this time, rural recipients may only use annual apportionments of Section 5311 (Rural) formula funding at 100% Federal share for COVID-19 related capital expenses where grants were obligated under the authority of the Emergency Relief program on or before May 11, 2023,

FTA also provided supplemental funding to help the nation’s public transportation systems respond to the COVID-19 pandemic. Rural transit agencies should consult with their State DOT for information on continued availability of

Coronavirus Aid, Relief, and Economic Security (CARES) Act,

Coronavirus Response and Relief Supplemental Appropriations Act, 2021 (CRRSAA), and

American Rescue Plan Act of 2021 (ARP) funding for transit in their state. Answers to

Frequently Asked Questions about these supplemental funding programs are available on FTA’s web site.

Other U.S. DOT Programs

Other U.S. DOT programs may fund rural transit services. For example, as explained in the FTA Section 5311 circular, states can transfer funds from certain Federal Highway Administration (FHWA) programs to FTA transit programs, often referred to as flexible funds or “flex funds.”

Flex funding is defined as the broad authority to transfer funding between federal agencies. The funding can be used for access improvements to and around transit such as:

- Pedestrian access and walkways

- Bicycle/pedestrian access

- Signage

- Enhanced access for persons with disabilities to public transportation

- Bus shelters

- Lighting

- Catchment area: any pedestrian improvements within a half-mile and any bicycle improvement within 3 miles of a transit station are considered transit related (improvements must be physically or functionally related to transit services)

- “Complete trip” network design and project planning

Transit managers seeking more information about the availability of flex funds in their state should contact their State DOT transit program representative. General information about how states can transfer these funds is available in Appendix D of FTA Circular C 9040.1G Formula Grants for Rural Areas: Program Guidance and Application Instructions (Section 5311). FTA and FHWA provided helpful slides with explanations and examples of flex funding from a Flexible Funding for Transit Access webinar held in June 2022. General questions on flex funding can be sent to flexfunds@dot.gov.

Additional FTA funding programs that fund mobility management projects are discussed in the Coordination and Mobility Management section of the Toolkit.

Non-Federal Sources

State Grant Programs

In addition to administering FTA programs, State DOTs may offer state funding for rural public transportation services. A state’s FTA funding application process for FTA programs may also be the application to apply for state funds, but this is not always the case. Contact the State DOT for information about state-level funding opportunities.

Medicaid Non-Emergency Medical Transportation (NEMT) Contracts

Medicaid is required to make certain that every Medicaid beneficiary who has no other means of transportation has access to transportation needed to receive covered medical care. (42 CFR Section 431.53 Assurance of Transportation) On September 28, 2023, the Centers for Medicare and Medicaid Services/Center for Medicaid and CHIP Services (CMS) issued guidance for the provision of Medicaid non-emergency medical transportation (NEMT). The stated purpose of the guidance, Assurance of Transportation: A Medicaid Transportation Coverage Guide, is to provide “a one stop source of federal requirements and state flexibilities.”

As stated in TCRP Research Report 202, “Handbook for Examining the Effects of Non-Emergency Medical Transportation Brokerages on Transportation Coordination,” Medicaid is the federal government’s largest program for human services transportation. Medicaid funds NEMT services. Historically, Medicaid NEMT contracts have been a major source of funding for rural public transportation providers who often provide coordinated human service transportation services in the context of the public transportation system. Each state administers its own Medicaid NEMT program, with varying approaches and opportunities for contracting to provide these services. Depending upon the state’s current approach and the rates offered to transportation providers, a Medicaid NEMT contract may be a viable funding opportunity for an organization. To learn more about the NEMT opportunities in a state, check with the state Medicaid program and peers across the state (for example, through the state transit association).

Human Service Transportation Contracts

Many rural public transportation programs transport consumers of human service agencies whose rides are paid for through a contract with the human service agency. Examples include the Area Agency on Aging (AAA) and organizations with employment and other programs for people with disabilities.

Local Taxes

Rural public transit systems are sometimes funded through a local tax, such as a portion of local sales or property taxes. If the transit system serves a major tourist destination, and transports employees and visitors to hotels near this destination, the transit manager may wish to explore the possibility of a lodging tax to support transit.

Local Government Funds

The counties, cities, and/or towns served by a rural public transit system often provide funding for the service as a public service benefiting residents as well as customers and employees of local businesses.

Advertising Revenue

Transit agencies can sell advertising space to other organizations on and in buses, and this is a common source of additional revenue. Advertising space could also be sold on printed brochures, within passenger facilities, and on benches and shelters at bus stops, for example. For more information on selling advertising space on vehicles, see National RTAP’s Advertising Best Practices: Bus Wraps and In-Kind Advertising Spotlight Article.

Public/Private Partnerships and Sponsorships

Some rural transit systems have partnered with local community organizations, businesses, or employers to sponsor transportation services that benefit their customers and employees, and transit managers can sometimes use an entrepreneurial approach to leveraging support. Hospitals sometimes sponsor a transit route to ensure that their patients can get to and from their appointments. A major employer with difficulty hiring employees may be interested in sponsoring a transit route connecting their work site to residential areas at shift start and end times. Tourist destinations and colleges/universities with limited parking are other potential sponsors. The National RTAP Transportation to Scenic Destinations Best Practices Spotlight article provides examples of three rural transit agencies that have leveraged funding for innovative transportation solutions to scenic destinations.

Passenger Fares

The fares that passengers pay to use services can also provide a source of funding, though typically fares cover only a small portion of the full cost to provide rural public transportation service.

Volunteers and In-Kind Support

In addition to cash revenues, rural transit agencies can also be partially supported by volunteer and in-kind services. Some rural transit systems rely on volunteer drivers to provide cost-effective services. It may be possible to enlist local college or university classes or student interns to conduct planning studies, develop marketing materials, or to conduct outreach efforts. Other types of in-kind support can include facility use, utility services, or donated staff time. Note that to be eligible as local match for an FTA grant, the value of volunteers and in-kind support must be documented.

Grant Writing Tips

- Read and reread the funding notification documents, and call the funding source to ask critical questions. There are no dumb questions, but the grant application could face the dire consequence of being eliminated from review for a simple failure to follow the directions.

- Grant reviewers always cite the same complaint about the grants they review: “They failed to answer the questions.” Be certain that the narrative answers all the questions the application asks, and fully responds to the specific questions that are asked.

- More is not necessarily better. Yes, it is critical that the need statement cite the demographics relevant to the transit service area for which funding is sought, but those demographics should be succinctly stated and remain focused on establishing the need for funding support. Too many statistics will rapidly turn the grant reviewer off.

- A transit grant application is basically a summation of a proposed transit service plan. Thus, it requires the inclusion of project tasks, benchmarks, key milestones, key personnel, deliverables, routes, and schedules, as necessary to concisely describe that service plan and justify its sustainability, expansion, or additional capital acquisitions.

- Be sure that the funding request reflects what is required to achieve the service plan’s goals. Also, be clear on the match requirements, and whether the match can be made in-kind or must be made with cash.

- Consult relevant FTA circulars for vital information on allowable costs, eligible project activities, and essential procurement procedures that will drive the project’s timeline.

- Proofread and share the draft with an individual outside of the applicant agency, as they will catch errors program staff may miss. Proofread again and double-check the grant’s final assembly against the grant guidance documents.

National RTAP’s Grant Writing Made Easy: How to Write a Successful Grant Application Technical Brief offers additional suggestions. In 2017, National RTAP hosted a Grant Writing 101 Webinar, and the webinar slides can also be downloaded.

Section Sources

- 2 CFR Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards

- 42 CFR Section 431.53 Assurance of Transportation

- Burkhardt, Jon E., Beth Hamby, Littleton C. MacDorman, Brian E. McCollom, and Gordon A. Schreur, Comprehensive Financial Management Guidelines for Rural and Small Urban Public Transportation Providers, prepared for the North Carolina DOT, American Association of State Highway and Transportation Officials (AASHTO) Multi-State Technical Assistance Project (MTAP), and U.S. DOT/FTA (1992)

- Centers for Medicare and Medicaid Services/Center for Medicaid and CHIP Services (CMS), Assurance of Transportation: A Medicaid Transportation Coverage Guide

- Federal Transit Administration, American Rescue Plan Act of 2021 web page

- Federal Transit Administration, Coronavirus Aid, Relief, and Economic Security (CARES) Act web page

- Federal Transit Administration, Coronavirus Response and Relief Supplemental Appropriations Act of 2021 web page

- Federal Transit Administration, Dear Colleague Letter: Announcing Guidance Updates Associated with the End of COVID-19 Disaster Declarations (May 2, 2023)

- Federal Transit Administration, Emergency Relief Program web page

- Federal Transit Administration, Program Fact Sheets under the Bipartisan Infrastructure Law

- Federal Transit Administration, Public Transportation Emergency Relief Funds for Transit Systems Affected by Major Declared Disasters Occurring in Calendar Years 2017 & 2020-2022 web page

- Federal Transit Administration, Frequently Asked Questions from FTA Grantees Regarding Coronavirus Disease 2019 (COVID-19) web page

- FTA Circular C 5010.1E Award Management Requirements (2018)

- FTA Circular C 9040.1G Formula Grants for Rural Areas: Program Guidance and Application Instructions (Section 5311) (2014)

- National RTAP, Advertising Best Practices: Bus Wraps and In-Kind Advertising Spotlight Article (2017)

- National RTAP, Cost Allocation Calculator

- National RTAP, Fundamental Financial Management for Rural Transit Agencies (2020)

- National RTAP, Transportation to Scenic Destinations Best Practices Spotlight article (2021)

Updated March 14, 2024

National RTAP offers one-stop shopping for rural and tribal transit technical assistance products and services. Call, email, or chat with us and if we can’t help with your request, we’ll connect you with someone who can!

" National RTAP offers one-stop shopping for rural and tribal transit technical assistance products and services. Call, email, or chat with us and if we can’t help with your request, we’ll connect you with someone who can! "

Robin Phillips, Executive Director

" You go above and beyond and I wanted to let you know that I appreciate it so much and always enjoy my time with you. The presentations give me so much to bring back to my agency and my subrecipients. "

Amy Rast, Public Transit Coordinator Vermont Agency of Transportation (VTrans)

" I always used the CASE (Copy And Steal Everything) method to develop training materials until I discovered RTAP. They give it to you for free. Use it! "

John Filippone, former National RTAP Review Board Chair

" National RTAP provides an essential service to rural and small transit agencies. The products are provided at no cost and help agencies maximize their resources and ensure that their employees are trained in all aspects of passenger service. "

Dan Harrigan, Former National RTAP Review Board Chair

" We were able to deploy online trip planning for Glasgow Transit in less than

90 days using GTFS Builder. Trip planning information displays in a riders'

native language, which supports gencies in travel training and meeting Title VI

mandates. "

Tyler Graham, Regional Transportation Planner Barren River Area Development District

Slide title

" Having a tool like GTFS Builder is really light years ahead of what it used to be at one time in terms of how fast you can put everything together. Our university students really can't imagine transit without it, so I think it's very important for us in terms of attracting that particular demographic. "

Michael Lachman, Transportation Services Manager HAPCAP - Athens Transit

Slide title

" In the past we used proprietary database software that was very challenging, very murky, and hard to update. GTFS Builder is a great opportunity to make this more user-friendly, more readily updatable and it

would enable us to show how to create a GTFS to more of the staff. "

Jaime McKay, Former Manager of Direct Services Center for Mobility Equity

Slide title

" Collaboration is a buzz word these days in the industry. On behalf of our Tribal segment, I appreciate RTAP for making Tribes a partner in industry opportunities. The organization goes over and beyond reaching partners one would not expect in a busy industry such as public transportation. Thank you for your tireless efforts! "

Franklin Akoneto, Comanche Nation

Slide title

"We are so very thankful for all your transportation training materials. Your resources are as valuable as gold!"

Holly Walton, Transportation Assistant Manager, Curative Connections

A program of the Federal Transit Administration administered by the Neponset Valley TMA

National RTAP is committed to making this website accessible to persons with disabilities. If you need assistance accessing any content on our website or need alternative formats for our materials, please contact us at info@nationalrtap.org or 781-404-5020.

by National RTAP |